Help improve your council website!

We’re redesigning it to make services easier to use. Tell us what works and what doesn’t by completing our 5 minute survey. Have your say by 18 March 2026.

Your Council Tax pays for:

Councillors have agreed the 2026/27 budget at a full council meeting on Wednesday 25 February 2026. You can read more in our news story.

This year we’ve had to take the tough decision to increase Council Tax by 4.99% from April 2026 (excluding the GLA element). That’s an increase of around £1.54 per week on a Band D property and will help us to provide essential services for our community.

Council Tax information (PDF, 2.92 MB)

For information and advice, please visit our Struggling to pay your Council Tax page.

| £’000 | |

|---|---|

| Budget 2025/26 | 238,703 |

| Service Pressures & Improvements | 33,609 |

| Savings | (8,717) |

| Other corporate adjustments | 2,720 |

| Budget 2026/27 | 266,313 |

| Service | 25/26 Exp (£000) | 26/27 Exp (£000) |

|---|---|---|

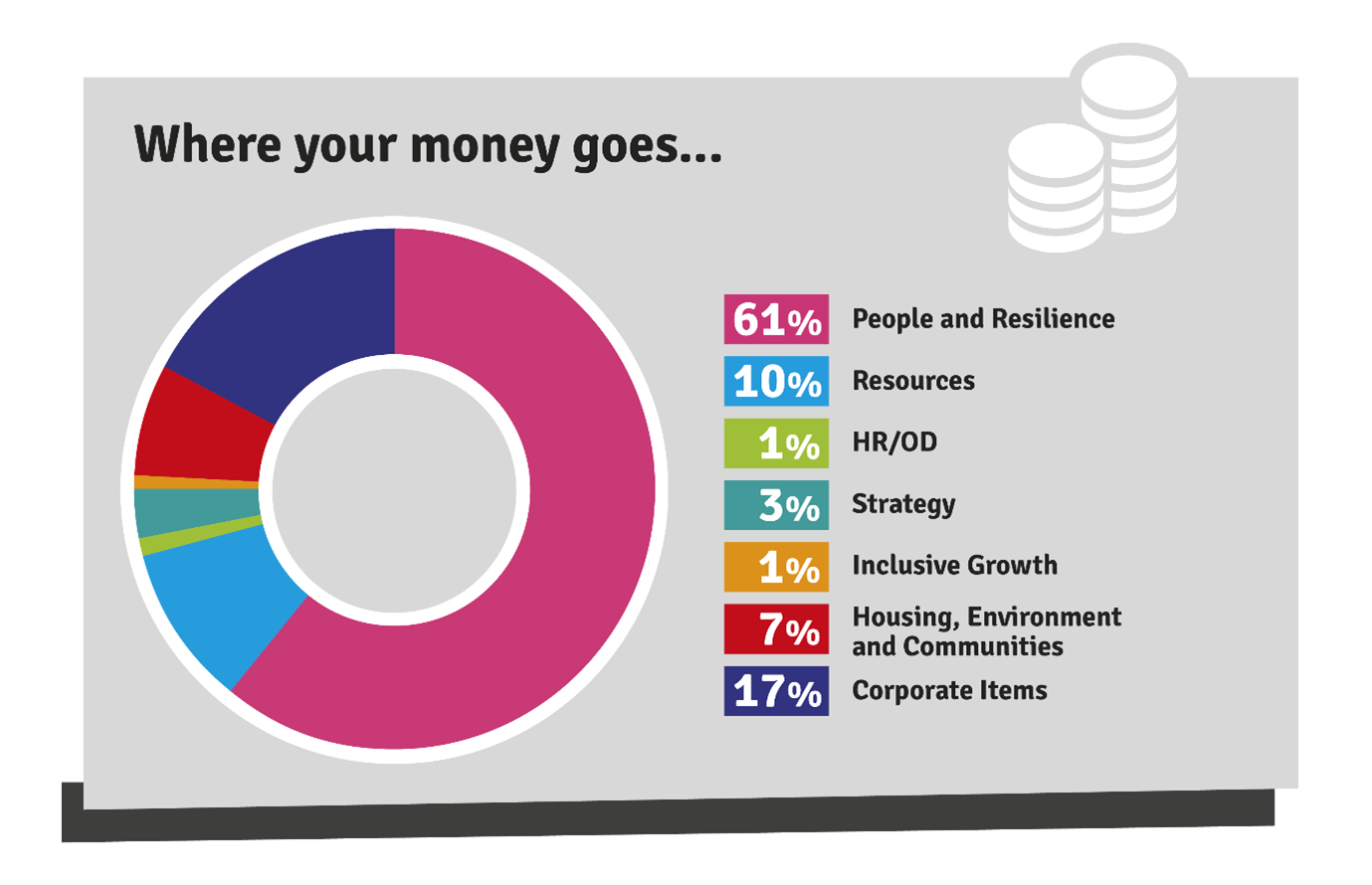

| People & Resilience | 142,246 | 151,606 |

| Resources | 24,598 | 27,041 |

| Human Resources & Organisational Development | 2,396 | 2,560 |

| Strategy | 5,706 | 6,911 |

| Inclusive Growth | 1,334 | 1,425 |

| Housing, Environment and Communities | 13,267 | 16,672 |

| Corporate Items | 49,156 | 60,097 |

| Total Net Expenditure | 238,703 | 266,313 |

| Gross Expenditure | 566.555 | 575.486 |

| Gross Income | 327.852 | 309.173 |

| Total Funding Required | 238.703 | 266.313 |

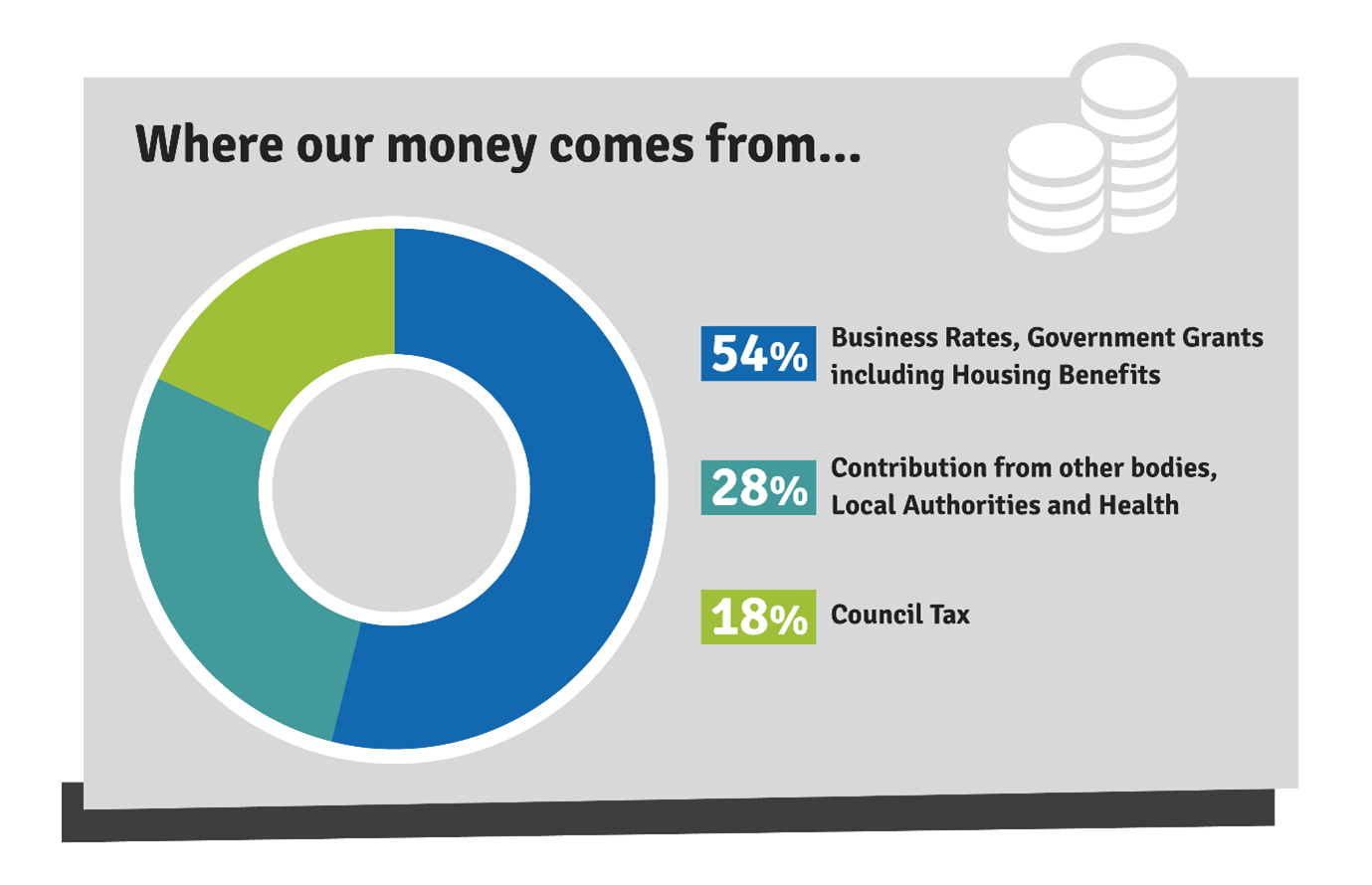

| Business Rates | 79.786 | 95.864 |

| Government Grants (Inc. Collection Fund) | 65.430 | 73.344 |

| Other Funding Sources | - | |

| Council Tax | 93.486 | 97.105 |

| Band D Council Tax | 2025/26 | 2026/27 | % Change |

|---|---|---|---|

| Number of Houses at Band D Equivalent | 58,146.80 | 57,526.52 | |

| London Borough of Barking & Dagenham | £1,607.76 | £1,687.99 | 4.99% |

| Greater London Authority Precept | £490.38 | £510.51 | 4.00% |

| Total | £2,098.14 | £2,198.50 | 4.80% |

The Secretary of State has made an offer to adult social care authorities. These are local authorities that exercise functions under Part 1 of the Care Act 2014. They include county councils in England, district councils in areas without a county council, London borough councils, the Common Council of the City of London, and the Council of the Isles of Scilly.

This offer gives adult social care authorities the option to apply an additional council tax charge, known as the adult social care precept, without the need to hold a referendum. The purpose of this precept is to help authorities meet their adult social care expenditure, and it was first introduced for the 2016–17 financial year.

Originally, the offer applied only up to the 2019–20 financial year. However, it has since been extended. If the Secretary of State decides to renew the offer for any given financial year, it must be approved by the House of Commons.

For the 2026/27 financial year, the Secretary of State has permitted adult social care authorities to levy an adult social care precept of up to 2%, in addition to the standard allowable council tax increase of 2.99%.

The income raised from the adult social care precept is ring‑fenced. This means it can only be used to fund adult social care services that support some of the most vulnerable members of the community, including older people and adults with disabilities.

You can find information on the Greater London Authority (GLA) charge on Council Tax including how much it is and what it is used for in Your council tax and the GLA (PDF, 97.02 KB).

ELWA has the statutory responsibility for the disposal of household and commercial waste collected by the London Boroughs of Barking & Dagenham, Havering, Newham and Redbridge, and for the provision of Reuse and Recycling Centres in its area.

Waste disposal is carried out under a 25-year Integrated Waste Management Services Contract by Biffa (formerly Renewi plc). ELWA receives funding support via the government’s Private Finance Initiative.

ELWA’s total levy requirement is £80,985,000 (2025/26: £76,844,000). The 2026/27 budget includes an inflationary increase in contract and operational costs as well as provision for increases in waste tonnages. There has also been a reduction in the level of the packaging extended producer responsibility funding (relative to the 2025/26 budget). This is partially offset by the release of the prior year and 2025/26 forecast budget surpluses. Further information can be found at the East London Waste website. The increase for the London Borough of Barking & Dagenham is 3.95%.

The major part of the ELWA Levy is apportioned on the basis of relative amounts of household waste delivered to ELWA by each of the four constituent London Boroughs, with the remainder apportioned according to their Council Tax Bases.

The Levy on the London Borough of Barking & Dagenham for 2026/27 is £15,019,000 (2025/26: £14,448,000).

Lee Valley Regional Park is a unique leisure, sports and environmental destination for all residents of London, Essex and Hertfordshire. The 26 mile long, 10,000 acre Park, much of it formerly derelict land, is partly funded by a levy on the council tax. This year there has been a 2.25% increase in this levy.

Find out more about hundreds of great days out, world class sports venues and award-winning parklands at the Lee Valley Regional Park Authority website.

Budget/Levy 2025/26 (£'million)

| 2024/25 | 2025/26 | |

|---|---|---|

| £m | £m | |

| Authority Operating Expenditure | 15.6 | 16.5 |

| Authority Operating Income | (8.0) | (8.5) |

| Net Service Operating Costs | 7.6 | 8.0 |

| Financing Costs - Debt servicing/repayments | 2.1 | 2.0 |

| Financing Costs - Capital investment | 1.6 | 2.1 |

| Total Net Expenditure | 11.3 | 12.1 |

| Net use of Reserves | (0.0) | (0.0) |

| Total Levy | (11.3) | (11.5) |

Further details on how this budget is spent and the amount each council contributes can be found on the Lee Valley Regional Park Authority website.

The London Pensions Fund Authority (LPFA) raises a levy each year to meet expenditure on premature retirement compensation and outstanding personnel matters for which LPFA is responsible and cannot charge to the pension fund. These payments relate to former employees of the Greater London Council

(GLC), the Inner London Education Authority (ILEA) and the London Residuary Body (LRB).

For 2026/27, the income to be raised by levies is set out below. The Greater London levy is payable in all boroughs, the Inner London levy only in Inner London Boroughs (including the City of London). The figures show the total to be raised.

| Inner London | £7,000,000 |

|---|---|

| Greater London | £1,000,000 |

| Total | £8,000,000 |

From 2022 onwards, a portion of the amount previously raised as levies is being paid into the LPFA Pension Fund to address a funding deficit in respect of former GLC, ILEA, and LRB employees. Based on the experience of past years, the inclusion here of LPFA contact details results in

enquiries directed to us which only relate to borough matters and not the levy, so they are omitted.

The Environment Agency is a levying body for its Flood and Coastal Erosion Risk Management Functions under the Flood and Water Management Act 2010 and the Environment Agency (Levies) (England and Wales) Regulations 2011.

The Environment Agency has powers in respect of flood and coastal erosion risk management for 5200 kilometres of main river and along tidal and sea defences in the area of the Thames Regional Flood and Coastal Committee. Money is spent on the construction of new flood defence schemes, the maintenance of the river system and existing flood defences together with the operation of a flood warning system and management of the risk of coastal erosion. The financial details are:

Thames Regional Flood and Coastal Committee

| 2025/2026 '000s | 2026/2027 '000s | |

|---|---|---|

| Gross Expenditure | £138,500 | £103,602 |

| Levies Raised | £13,030 | £13,289 |

| Total Council Tax Base | 5,453 | 5,515 |

The majority of funding for flood defence comes directly from the Department for the Environment, Food and Rural Affairs (Defra). However, under the new Partnership Funding rule not all schemes will attract full central funding.To provide local funding for local priorities and contributions for partnership funding the Regional Flood and Coastal Committees recommend through the Environment Agency a local levy.

A change in the gross budgeted expenditure between years reflects the programme of works for both capital and revenue needed by the Regional Flood and Coastal Committee to which you contribute. The total Local Levy raised by this committee has increased by 1.99%

The total Local Levy raised has increased from £13,029,850 in 2025/2026 to £13,289,144 for 2026/2027